NYSE (daily chat)

+8

Intint

svilen_k

Никола20

jori

пич

ED

pipbel

Money (Admin)

12 posters

Страница 21 от 48

Страница 21 от 48 •  1 ... 12 ... 20, 21, 22 ... 34 ... 48

1 ... 12 ... 20, 21, 22 ... 34 ... 48

Re: NYSE (daily chat)

Re: NYSE (daily chat)

Sold half of my JPM position @ $156.00

Cash ready for bargain hunting!

Така е, ако не умувах толкова можеше вчера да продам на $160+

Cash ready for bargain hunting!

Така е, ако не умувах толкова можеше вчера да продам на $160+

Money- Брой мнения : 1001

Join date : 17.10.2021

Re: NYSE (daily chat)

Re: NYSE (daily chat)

pipbel написа:

Seems so...

And нихт ферщеен фъкинг дойчо

https://certificates.societegenerale.de/product-details/SF6DCP

https://www.theice.com/products/197/EUA-Futures

LONG EUA (Carbon price)

volaswap- Брой мнения : 639

Join date : 16.11.2021

Re: NYSE (daily chat)

Re: NYSE (daily chat)

volaswap написа:

get in here

https://sg-zertifikate.de/product-details/SF6DCP

no hikes relevant

Seems so...

And нихт ферщеен фъкинг дойчо

pipbel- Admin

- Брой мнения : 419

Join date : 11.10.2021

Re: NYSE (daily chat)

Re: NYSE (daily chat)

pipbel написа:

To и аз съм съгласен с него, ама е повече в минало време това.

След 6 хайка планирани за 22 и 23г положението няма да е баш същото.

За мен и половината на тях е прекомерно и ще ни вкара в рецесия. Май и пазара струва ми се мисли нещо подобно...или поне почва да няма доверие на преценката на фед...затова и жълтия дори пълзи нагоре тия дни.

get in here

https://sg-zertifikate.de/product-details/SF6DCP

no hikes relevant

volaswap- Брой мнения : 639

Join date : 16.11.2021

Re: NYSE (daily chat)

Re: NYSE (daily chat)

Money написа:

Инак съм съгласен с това - stay invested in risk assets.

To и аз съм съгласен с него, ама е повече в минало време това.

След 6 хайка планирани за 22 и 23г положението няма да е баш същото.

За мен и половината на тях е прекомерно и ще ни вкара в рецесия. Май и пазара струва ми се мисли нещо подобно...или поне почва да няма доверие на преценката на фед...затова и жълтия дори пълзи нагоре тия дни.

pipbel- Admin

- Брой мнения : 419

Join date : 11.10.2021

Re: NYSE (daily chat)

Re: NYSE (daily chat)

volaswap написа:

Plenty of people are calling for an imminent stock market crash, but they are missing a key point: inflation-adjusted interest rates are still way below the estimated equilibrium levels! Why does that matter?

Real yields are very relevant for savers, investors, borrowers and asset class valuations: it's not only the absolute level that matters though, but also the relative level against the equilibrium real interest rate (r*).

A very low absolute risk-free real interest rate matters because:

1) It punishes savers and investors by rewarding very little (or even inflicting negative returns) on savings and risk-free investments

2) It helps borrowers to significantly reduce their real debt servicing cost, as debts are inflated away while nominal interest rate costs remain low. With the same real income, borrowers are now able to ''afford'' more leverage as servicing costs get reduced (notice: savers are punished by # 1, but they also get the benefits of # 2)

3) As long as earnings and nominal economic activity deliver, very low risk-free real interest rates will help drive portfolio inflows into risk assets and encourage higher valuations.

But it's not all about the absolute level: real yields relative to the equilibrium level r* are also very important.

R-star is the equilibrium real interest rate the economy can withstand while generating its potential, long-term growth and without overheating or cooling down too much.

R* is influenced by long-term drivers of real economic growth, and in particular by the growth of the active workforce (labor supply growth), its productivity and capital productivity.

The equilibrium rate r* has obviously been trending down fast over the last 40 years as our active workforce keeps growing less and less (ageing population), disruptive technologies advance at a very fast pace and capital misallocation is all over the place.

Hence, lower real yields are just a strong trend likely to stay but what matters is ''how low'' they are against estimates of r* -> my own model points to r* being around 0.25% in the US, and a negative (!) number in EU.

Nevertheless, observed real yields are now very low not only in absolute terms, but also against r*.

In 2013 (taper tantrum) and 2018 (equity market sell-off), real rates significantly overshoot r* for a while causing distress in the system which ultimately turned into risk-off episodes.

Today, US real yields are 100 bps+ below estimated equilibrium levels and that implies that monetary and financial conditions are still very loose: the doomsayers might have to wait a bit longer.

Инак съм съгласен с това - stay invested in risk assets.

Money- Брой мнения : 1001

Join date : 17.10.2021

Re: NYSE (daily chat)

Re: NYSE (daily chat)

Ама това Феда да обяви tightening и 10YR USTs да паднат е наистина weird. Освен ако не чакат рецесия.

Според мене Фед ще даде заден ход при най-малкия сигнал, че инфлацията отшумява.

Според мене Фед ще даде заден ход при най-малкия сигнал, че инфлацията отшумява.

Money- Брой мнения : 1001

Join date : 17.10.2021

Re: NYSE (daily chat)

Re: NYSE (daily chat)

pipbel написа:Mишо, някакъв коментар по представянето на асет класовете след фед новините ?

Не го ли намираш за... weird

Plenty of people are calling for an imminent stock market crash, but they are missing a key point: inflation-adjusted interest rates are still way below the estimated equilibrium levels! Why does that matter?

Real yields are very relevant for savers, investors, borrowers and asset class valuations: it's not only the absolute level that matters though, but also the relative level against the equilibrium real interest rate (r*).

A very low absolute risk-free real interest rate matters because:

1) It punishes savers and investors by rewarding very little (or even inflicting negative returns) on savings and risk-free investments

2) It helps borrowers to significantly reduce their real debt servicing cost, as debts are inflated away while nominal interest rate costs remain low. With the same real income, borrowers are now able to ''afford'' more leverage as servicing costs get reduced (notice: savers are punished by # 1, but they also get the benefits of # 2)

3) As long as earnings and nominal economic activity deliver, very low risk-free real interest rates will help drive portfolio inflows into risk assets and encourage higher valuations.

But it's not all about the absolute level: real yields relative to the equilibrium level r* are also very important.

R-star is the equilibrium real interest rate the economy can withstand while generating its potential, long-term growth and without overheating or cooling down too much.

R* is influenced by long-term drivers of real economic growth, and in particular by the growth of the active workforce (labor supply growth), its productivity and capital productivity.

The equilibrium rate r* has obviously been trending down fast over the last 40 years as our active workforce keeps growing less and less (ageing population), disruptive technologies advance at a very fast pace and capital misallocation is all over the place.

Hence, lower real yields are just a strong trend likely to stay but what matters is ''how low'' they are against estimates of r* -> my own model points to r* being around 0.25% in the US, and a negative (!) number in EU.

Nevertheless, observed real yields are now very low not only in absolute terms, but also against r*.

In 2013 (taper tantrum) and 2018 (equity market sell-off), real rates significantly overshoot r* for a while causing distress in the system which ultimately turned into risk-off episodes.

Today, US real yields are 100 bps+ below estimated equilibrium levels and that implies that monetary and financial conditions are still very loose: the doomsayers might have to wait a bit longer.

volaswap- Брой мнения : 639

Join date : 16.11.2021

Re: NYSE (daily chat)

Re: NYSE (daily chat)

pipbel написа:Mишо, някакъв коментар по представянето на асет класовете след фед новините ?

Не го ли намираш за... weird

Като гледам 10YR treasury-то какво прави, явно пазарът смята, че Федът ще сгреши ако дигне лихвите три пъти през 2022. В моменат го гладам на 1.389%. За мене това показва очаквания за рецесия заради прекалено бързо дигнати лихви.

Последната промяна е направена от Money на Пет Дек 17, 2021 2:09 pm; мнението е било променяно общо 1 път

Money- Брой мнения : 1001

Join date : 17.10.2021

Re: NYSE (daily chat)

Re: NYSE (daily chat)

Това е от вторник.

Morgan Stanley reiterates Disney as overweight

Morgan Stanley kept its buy rating on Disney and said it sees more upside in the stock in 2022.

“As part of our Year-Ahead Outlook, we 1) present the key questions weighing on sentiment, 2) take a deep dive into content spending, and 3) update our forecast. While we trim our legacy earnings outlook, we think shares have overreacted and see over 20% upside in shares from here, remain OW.”

Money- Брой мнения : 1001

Join date : 17.10.2021

Re: NYSE (daily chat)

Re: NYSE (daily chat)

Mишо, някакъв коментар по представянето на асет класовете след фед новините ?

Не го ли намираш за... weird

Не го ли намираш за... weird

Последната промяна е направена от pipbel на Пет Дек 17, 2021 2:04 pm; мнението е било променяно общо 1 път

pipbel- Admin

- Брой мнения : 419

Join date : 11.10.2021

Re: NYSE (daily chat)

Re: NYSE (daily chat)

пич написа:IBM държи в този спад, не мърда. Който си е железен, си е железен. Логиката е при ръст да изхвърчи като тапа.

За да изхварчи като тапа трябва да има по-сериозен катализатор под формата на upgrade-ове от инвестиционните банки. Те в момента имат много хладно отношение към IBM. Не знам колко време ще им трябва, за да променят инерцията от преди. IBM много дълго буксуваха и сега повечето анализатори не вярват, че звездата им може да изгрее отново.

Мисля, че за сега ще пълзи бавно нагоре, докато не ги забележат в топ банките на Уол Стрийт. Трябва малко търпение тука.

#IBM #FundamentalValue

Money- Брой мнения : 1001

Join date : 17.10.2021

Re: NYSE (daily chat)

Re: NYSE (daily chat)

IBM държи в този спад, не мърда. Който си е железен, си е железен. Логиката е при ръст да изхвърчи като тапа.

пич- Брой мнения : 115

Join date : 14.10.2021

Re: NYSE (daily chat)

Re: NYSE (daily chat)

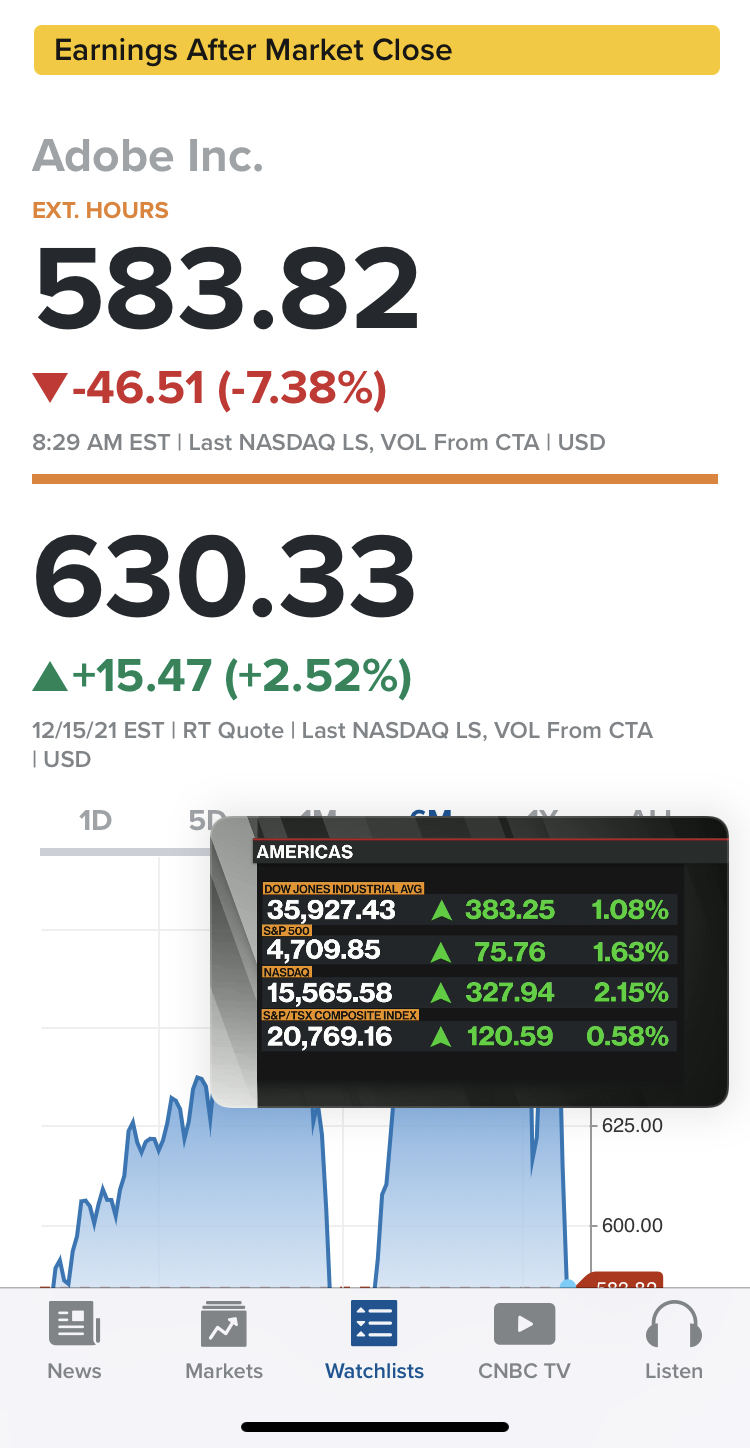

Дори (Adobe) да има един по-лош тримесечен отчет, ще се преживее, щом като има перспектива

пич- Брой мнения : 115

Join date : 14.10.2021

Re: NYSE (daily chat)

Re: NYSE (daily chat)

Adobe е много добре за дългосрочно. Странно как рязко падна днес. Отчетът е след камбаната. Нямам друго обяснение освен, че спадът е в резултат инсайдър информация. Която обаче може и да е непълна и довечера в AH акцията да отиде нагоре.

Money- Брой мнения : 1001

Join date : 17.10.2021

Re: NYSE (daily chat)

Re: NYSE (daily chat)

И аз взех 25 бройки Adobe по 505,60 €, да опитам този вкус .

Днес ще ги дават по Bloomberg, с 9-10% надолу.

#ADBE

Днес ще ги дават по Bloomberg, с 9-10% надолу.

#ADBE

пич- Брой мнения : 115

Join date : 14.10.2021

Re: NYSE (daily chat)

Re: NYSE (daily chat)

Явно пазара не е откоригирал достатъчно, реално погледнато наистина много малко сме от най-високите горни нива.

пич- Брой мнения : 115

Join date : 14.10.2021

Re: NYSE (daily chat)

Re: NYSE (daily chat)

Today decided to sell Shopify from 95 EUR to 1243 EUR.

Interesting this is pure coincedence. 2018 I boight as there was one guy shorting it and the stock fell 15%. From by the dip got to one of the best stories... But I see its as too overvalued...

Interesting this is pure coincedence. 2018 I boight as there was one guy shorting it and the stock fell 15%. From by the dip got to one of the best stories... But I see its as too overvalued...

volaswap- Брой мнения : 639

Join date : 16.11.2021

Страница 21 от 48 •  1 ... 12 ... 20, 21, 22 ... 34 ... 48

1 ... 12 ... 20, 21, 22 ... 34 ... 48

Страница 21 от 48

Права за този форум:

Не Можете да отговаряте на темите|

|

|